FAQs: How much is my house worth?

📣 To begin with, I will send you an Automated Valuation Method (AVM) price and range, using helpful tools that real estate professionals like me use, followed by performing a proper Comparative Market Analysis (CMA) after having seen your home, its condition and understand what upgrades and enhancements you’ve recently made to the home, as well as any structural changes. 🏡 If you’re not ready to sell, I can still share this information with you at no cost and with no obligation. Part of my job as your listing agent will be to help you understand how to properly price your home for the market, so it attracts the most buyers and is competitive with all other homes on the market, comparable to yours. Contact me to learn more about AVM vs. CMA and to get signed up to receive an estimate, after which I will send you further helpful details. ✅ 🎯 The Automated Valuation Model (AVM) vs. a Comparative Market Analysis (CMA)🎯 See what your home is worth (instant home price estimate)🎯 Track your home wealth with Homebot 🎬 Taking Your Home to Market🎬 Why You Need an ABR® for Your Next Home Search🎬 I'm Your ABR® - FAQs for Buyers in Metro Phoenix ☎️ Mobile 602-517-4463📧 mail@jasonpetersonrealtor.com🌐 ArizonaMarketWatch.com🌐 UtahMarketWatch.com

FAQs: Should I consider paying for some of the buyer’s closing costs?

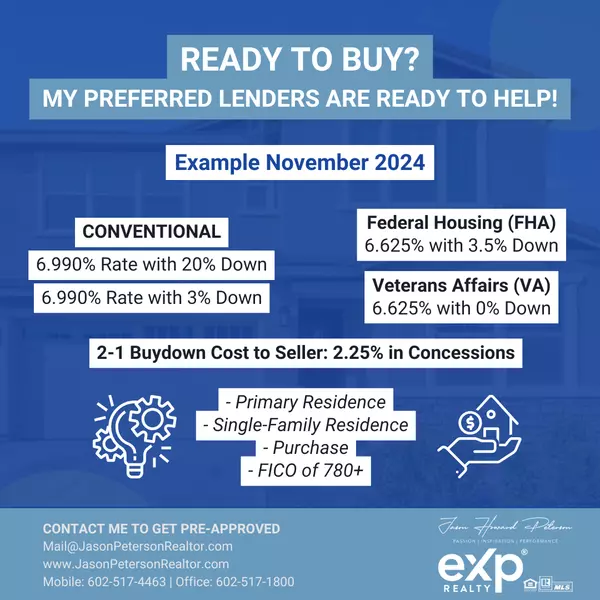

📣 Each residential real estate transaction is unique with its own negotiation specifics. Often, you’ll have a great buyer that needs assistance which may in turn be beneficial for you as the seller, ultimately making that buyer’s offer more attractive for both parties and getting the home sold / closed quicker. 🏡 You may choose to offer seller concessions to help the buyer buydown their interest rate, or help pay for some of their closing costs, which could entail the following: Loan origination fee; Mortgage application fee; Appraisal fee; Survey fee; 2-1 buydown financing cost to seller (2.25%); Wire transfer fee; Flood certification; PMI application fee; Home warranty; Hazard/Homeowner’s insurance; etc. ✅ 🎬 Taking Your Home to Market🎬 Why You Need an ABR® for Your Next Home Search🎬 I'm Your ABR® - FAQs for Buyers in Metro Phoenix ☎️ Mobile 602-517-4463📧 mail@jasonpetersonrealtor.com🌐 ArizonaMarketWatch.com🌐 UtahMarketWatch.com

FAQs: How much are standard seller closing costs?

📣 As previously mentioned, each transaction is unique as are the needs of each seller and buyer. When you hire me to list, and get your home sold in concert with a buyer agent, I will provide you with a Net Sheet which will list out all expected costs – we’ll adjust this as each offer comes through, so you’ll have a quick, and efficient look into your expected costs and ultimately your net proceeds. 🏡 Typically, anywhere from 7-10% of the total purchase price can be expected of which anywhere from 4-6% represents the real estate agent/brokerage’s commission (again, typically half of that is then set aside for the buyer’s agent/brokerage). Other various costs could include the following: Title search $150 - $400 Title insurance (owner’s policy) ca. 0.4% of sale price Escrow fee 0.5% of the final sale price Prorated property taxes and HOA dues based of course on when you sell Buyer’s closing costs you may accept e.g., home warranty, interest rate buydown, other seller concessions Neither Arizona nor Utah have required real estate transfer taxes due as does e.g., California. ✅ 🎬 Taking Your Home to Market🎬 Why You Need an ABR® for Your Next Home Search🎬 I'm Your ABR® - FAQs for Buyers in Metro Phoenix ☎️ Mobile 602-517-4463📧 mail@jasonpetersonrealtor.com🌐 ArizonaMarketWatch.com🌐 UtahMarketWatch.com

Categories

- All Blogs (896)

- Calculators & Financing (13)

- Certifications & Designations (34)

- Client Reviews & Testimonials (64)

- Do you need a REALTOR®? (59)

- eXp Realty (9)

- FAQs, Tips & Tutorials (246)

- From our Family to Yours (37)

- Home Valuation (42)

- Homebuyer (195)

- Homeowner & Home Seller (133)

- I'm Your ABR (92)

- Jason Howard Peterson (98)

- Landlord & Tenant (69)

- Listed, Leased & Sold (89)

- Market Watch: Reports & Trends (202)

- Meet Your Agent (38)

- NAR Changes/Updates (34)

- Valley of the Sun (55)

Recent Posts