FAQs: Should I consider paying for some of the buyer’s closing costs?

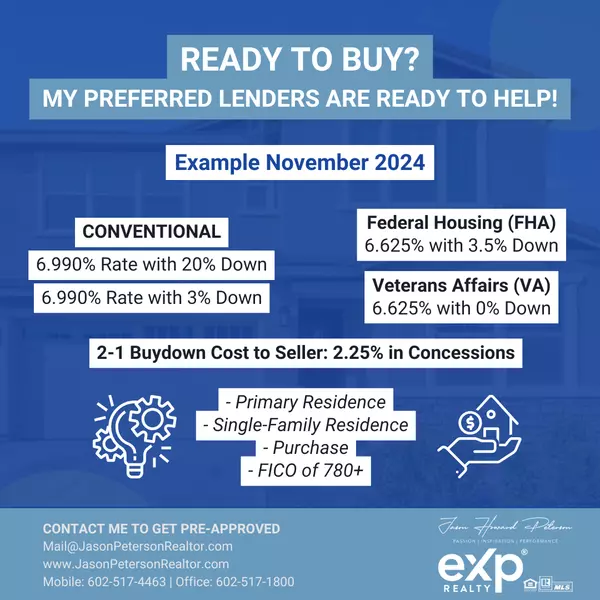

📣 Each residential real estate transaction is unique with its own negotiation specifics. Often, you’ll have a great buyer that needs assistance which may in turn be beneficial for you as the seller, ultimately making that buyer’s offer more attractive for both parties and getting the home sold / closed quicker. 🏡 You may choose to offer seller concessions to help the buyer buydown their interest rate, or help pay for some of their closing costs, which could entail the following: Loan origination fee; Mortgage application fee; Appraisal fee; Survey fee; 2-1 buydown financing cost to seller (2.25%); Wire transfer fee; Flood certification; PMI application fee; Home warranty; Hazard/Homeowner’s insurance; etc. ✅

Categories

- All Blogs (896)

- Calculators & Financing (13)

- Certifications & Designations (34)

- Client Reviews & Testimonials (64)

- Do you need a REALTOR®? (59)

- eXp Realty (9)

- FAQs, Tips & Tutorials (246)

- From our Family to Yours (37)

- Home Valuation (42)

- Homebuyer (195)

- Homeowner & Home Seller (133)

- I'm Your ABR (92)

- Jason Howard Peterson (98)

- Landlord & Tenant (69)

- Listed, Leased & Sold (89)

- Market Watch: Reports & Trends (202)

- Meet Your Agent (38)

- NAR Changes/Updates (34)

- Valley of the Sun (55)

Recent Posts

Metro Phoenix Home Team Welcomes Mrs. Payton Kelnhofer

NAR Consumers: Mortgages and Financing

Get Pre-Qualified and Pre-Approved Today!

NAR Consumers: Questions to Ask a Seller’s (Listing) Agent

NAR Consumers: Questions to Ask a Buyer’s (Selling) Agent

NAR Consumers: Buying Your First Home

Metro Phoenix Home Team Welcomes Mrs. Angela Wantink

Metro Phoenix Home Team: Jason Peterson & Associates

Metro Phoenix Home Team Welcomes Mr. Devon Chavis

Satisfied Client: Brett Tolpa

GET MORE INFORMATION