NAR Consumers: Mortgages and Financing

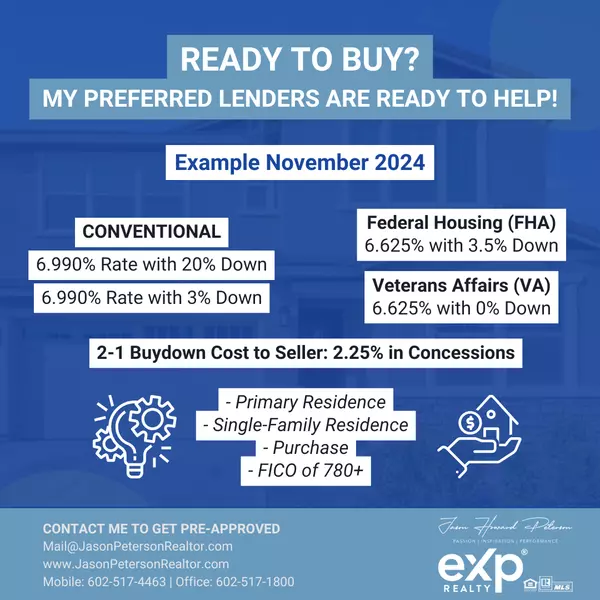

Buying a home is one of the largest personal and financial decisions you can make. For many buyers, the process includes finding a loan that will help you pay for your new home over time. An agent who is a REALTOR® can help you learn about your options. Here’s what else you need to know: What is a mortgage, and how do I get one? A mortgage is a loan offered by a bank or lender that lets you borrow money to purchase a home and repay over time with interest. Mortgages can take many forms, but one of the most popular options is a 30-year fixed rate mortgage. Many factors can affect the mortgage options available to you, including your down payment, personal finances (e.g., credit score, income, existing debt, employment history), and other factors like government policies, current interest rates, and what lender you are working with. Certain buyers, like first-time homebuyers and veterans, might be eligible for special financial assistance programs. What types of loans are there? Factors like where you are searching for a home and how long you plan to stay in your new home will help determine which loan type best suits you. Some options include: 📃 Fixed-rate mortgage: Sets an interest rate and monthly payment for the life of the loan, which is typically 15 or 30 years. 📃 Adjustable-rate mortgage (ARM): ARMs may offer interest rates that are lower than you could get with a fixed-rate mortgage for a chunk of the life of the loan, such as five or 10 years. However, after that point your interest rates are subject to change approximately once per year based on market conditions. What is a down payment, and how much will it be? Some lenders require buyers to pay a percentage of the home’s purchase price up front, which is known as a “down payment.” Your down payment can vary substantially depending on your mortgage agreement. Typically, if you pay more money up front, your monthly mortgage payment will be lower. Many local governments and non-profit organizations offer down payment assistance grants and loans if you meet certain requirements. Ask your agent or reach out to your local REALTOR® association for recommendations and guidance on what’s available. What is the difference between conventional and federal home loans? Conventional loans are financed by private lenders, such as banks, credit unions, and mortgage companies. They require stronger credit and higher down payments but may offer better rates. Federal loans are government-backed, meaning lenders carry less risk and can pass savings onto eligible borrowers who may not have pristine credit. Some federal loans include: 📃 Federal Housing Administration (FHA) Loan: FHA loans cater to first-time buyers and have flexible requirements and down payment options as low as 3.5%, depending on your credit score or debt-to-income ratio. 📃 Department of Veterans Affairs (VA) Loan: If you served in the U.S. military, you are eligible for a VA loan with no down payment and no mortgage insurance requirements. 📃 U.S. Department of Agriculture (USDA) Loan: The USDA Rural Development loan is designed for families purchasing a home in rural areas, requires zero down payment, and offers discounted mortgage interest rates. Are there other ways I can lower my out-of-pocket costs? Some sellers may offer to pay certain costs associated with purchasing a home for you, which are called concessions. Certain limits apply to concessions—please consult our guide to seller concessions for more information. You can also ask the seller to pay for your agent’s compensation, which does not count towards concession limits, as part of your purchase offer. Both are options that may reduce out-of-pocket and upfront expenses, helping you stretch your budget. However, keep in mind that the current banking system does not allow for agent compensation to be financed through a mortgage. Talk to your agent about building a home purchase plan that works with your budget. ✅ Please visit facts.realtor for more information and resources, and consult your real estate professional or attorney for details about state law where you are purchasing and/or selling residential real estate. 📣 REALTORS® are members of the National Association of REALTORS® 📚 Welcome to the Future of Residential Real Estate (Commissions Decoupled)📚 Then and Now: Decoupled Commission and New Flow of Compensation📚 Homebuyers: Here's What the NAR Settlement Means for You📚 Home Sellers: Here's What the NAR Settlement Means for You 📆 Schedule time with me to address any questions and concerns about buying, selling, and renting residential real estate in the Valley of the Sun (Metro Phoenix). 🏠 We'll get you where you need to go! 🚀 ☎️ Mobile 602-517-4463📧 Mail@JasonPetersonRealtor.com🌐 JasonPetersonRealtor.com

NAR Consumers: Questions to Ask a Seller’s (Listing) Agent

If you’re ready to sell your home, you should feel empowered to find and work with the agent who is the best fit for your needs. Here are ten questions you should consider when selecting an agent: Are you a REALTOR®? When you work with an agent who is a REALTOR®, you are working with a professional guided by ethical duties under the REALTOR® Code of Ethics, including the pledge to protect and promote the interests of their clients. What types of services can you provide me? Your agent can help you with marketing your property, interfacing with buyer’s agents, handling showings and open houses, negotiating the purchase agreement on your behalf, assisting throughout the closing process, and more. Are you familiar with the market where I am selling my home? Your agent must be licensed where you are selling your home. But they should also have the market knowledge to facilitate a successful transaction. While prior experience with the market where your property is located is not a requirement, local knowledge could help your agent develop a strategy that resonates with local buyers. What will be included in our listing contract? At the outset of your relationship, you and your agent will sign a listing agreement that says the agent can represent you and market your property to potential buyers and their agents and professionally assist you in establishing the sale price for your home. It will also lay out the type of professional representation your agent will provide and what they will be paid for those services. Remember that agent compensation is fully negotiable and not set by law. How did you arrive at your suggested list price for my home? Setting a strong initial asking price based on your agent’s knowledge of the market is important for capturing buyer interest and securing the best possible offer. Your agent should conduct market research to determine an appropriate price that both attracts prospective buyers and ensures you receive fair market value for your home. How will you market my home? Agents may use a variety of marketing methods to reach potential buyers, and they should walk you through the pros and cons of each option. For example, one tool agents use to market properties is a Multiple Listing Service (MLS) system, an online platform that compiles home listings from brokerages in a given market, to reach the largest possible pool of buyers and potentially attract the best offer. How do I attract potential buyers? There are many strategies that may help attract potential buyers. For example, offers of compensation—when you compensate another agent for bringing a buyer to successfully close the transaction—and seller concessions—when you cover certain costs associated with purchasing a home for the buyer—may lead to a better or faster offer by reducing out-of-pocket and upfront expenses for prospective buyers. What do I need to do to get my house ready? To prepare your home for listing, your agent may suggest investing in necessary repairs or other upgrades that may help enhance buyer interest in the property. How will you vet potential buyers? An important part of selling your home is ensuring that prospective buyers are financially prepared to follow through with their offer. Discuss with your agent how they plan to evaluate prospective buyers, which should include requiring a pre-approval letter to be submitted alongside the offer. Do you have references I can speak with? Many agents will be happy to connect you with satisfied clients they have worked with in the past who can speak to their experience. Access my Reviews and Testimonials from JasonPetersonRealtor.com – we value and are sincerely grateful for our clients and their testimonials. ✅ Please visit facts.realtor for more information and resources, and consult your real estate professional or attorney for details about state law where you are purchasing and/or selling residential real estate. 📣 REALTORS® are members of the National Association of REALTORS® 📚 Welcome to the Future of Residential Real Estate (Commissions Decoupled)📚 Then and Now: Decoupled Commission and New Flow of Compensation📚 Homebuyers: Here's What the NAR Settlement Means for You📚 Home Sellers: Here's What the NAR Settlement Means for You 📆 Schedule time with me to address any questions and concerns about buying, selling, and renting residential real estate in the Valley of the Sun (Metro Phoenix). 🏠 We'll get you where you need to go! 🚀 ☎️ Mobile 602-517-4463📧 Mail@JasonPetersonRealtor.com🌐 JasonPetersonRealtor.com

NAR Consumers: Questions to Ask a Buyer’s (Selling) Agent

If you’re ready to buy a home, you should feel empowered to find and work with the agent who is the best fit for your needs. Here are ten questions you should consider when selecting an agent: Are you a REALTOR®? When you work with an agent who is a REALTOR®, you are working with a professional guided by ethical duties under the REALTOR® Code of Ethics, including the pledge to protect and promote the interests of their clients. What types of services can you provide me? Agents may offer many types of services such as finding you homes that meet your criteria, accompanying you to showings, sharing their analysis of the market and available properties, negotiating on your behalf, and more. For more information about why you should work with a REALTOR®, read about the 179 Ways Agents Who Are REALTORS® Are Worth Every Penny. How well do you know the markets where I am searching for a home? Your agent must be licensed where you are buying a home. But they should also have the market knowledge to help you successfully find a home where you are searching. Do you have experience working with buyers in my situation? Many agents specialize in working with certain types of buyers, such as first-time buyers and veterans. Some also earn the Accredited Buyer’s Representative designation to gain specialized skills in working with buyers. Ask your prospective agent about their experience and any designations or certifications they have earned related to working with buyers like you. Can you tell me about your approach to scouting properties? Agents and brokerages across the country have different business models and use and provide various technology, tools, and resources to inform their search process. Discuss with your prospective agent how their unique approach will help you find the right home. What will be included in our written buyer agreement? Once you are working with your agent and before you tour a home together, your agent may be required to enter into a written buyer agreement with you that outlines the services the agent will provide you, and what they will be paid for those services. These agreements are fully negotiable. How long will we work together? Talk with your prospective agent about how long you would like to work together and ensure you feel comfortable with that arrangement. This term will be set out in your written buyer agreement. What are my options for paying you? Agent compensation is fully negotiable and can take many forms, such as a flat fee, a percentage of the purchase price, or an hourly fee. The written buyer agreement will contain the amount of compensation you agree on. You can also ask the seller to pay your broker’s compensation as part of your purchase offer or, in cases where a seller offers a concession, you may be able to use the funds to pay your broker for the value and services they provided you. Can you recommend service providers who can help me obtain a mortgage, make home repairs, or support other closing tasks? Your prospective agent may have prior experience or trusted relationships with providers in the area where you are purchasing a home and can be a great resource for facilitating these introductions. Access our Trusted Vendors and Services Providers to get started and let me know if you need any additional recommendations. Do you have references I can speak with? Many agents will be happy to connect you with satisfied clients they have worked with in the past who can speak to their experience. Access my Reviews and Testimonials from JasonPetersonRealtor.com – we value and are sincerely grateful for our clients and their testimonials. ✅ Please visit facts.realtor for more information and resources, and consult your real estate professional or attorney for details about state law where you are purchasing and/or selling residential real estate. 📣 REALTORS® are members of the National Association of REALTORS® 📚 Welcome to the Future of Residential Real Estate (Commissions Decoupled)📚 Then and Now: Decoupled Commission and New Flow of Compensation📚 Homebuyers: Here's What the NAR Settlement Means for You📚 Home Sellers: Here's What the NAR Settlement Means for You 📆 Schedule time with me to address any questions and concerns about buying, selling, and renting residential real estate in the Valley of the Sun (Metro Phoenix). 🏠 We'll get you where you need to go! 🚀 ☎️ Mobile 602-517-4463📧 Mail@JasonPetersonRealtor.com🌐 JasonPetersonRealtor.com

Categories

- All Blogs (896)

- Calculators & Financing (13)

- Certifications & Designations (34)

- Client Reviews & Testimonials (64)

- Do you need a REALTOR®? (59)

- eXp Realty (9)

- FAQs, Tips & Tutorials (246)

- From our Family to Yours (37)

- Home Valuation (42)

- Homebuyer (195)

- Homeowner & Home Seller (133)

- I'm Your ABR (92)

- Jason Howard Peterson (98)

- Landlord & Tenant (69)

- Listed, Leased & Sold (89)

- Market Watch: Reports & Trends (202)

- Meet Your Agent (38)

- NAR Changes/Updates (34)

- Valley of the Sun (55)

Recent Posts