NAR Consumers: Buying Your First Home

So, you’re ready to find your first home. But where do you begin? And what resources are available to help you? Here’s what you need to know as you embark on your homeownership journey:

Who is considered a first-time homebuyer? The definition of “first-time homebuyer” might be broader than you think. For example, it can refer to a person who has never owned a home, a person who has not owned a home in the last three years, or a single parent who has only previously owned a home with a spouse. The definition may vary by program, so check here for the Federal Housing Administration’s definition of a first-time homebuyer.

How do I find an agent? With the cost of housing at an all-time high, agents who are REALTORS® are here to help first-time homebuyers navigate challenges in the market and achieve the dream of homeownership. Agents may offer a wide range of services, such as finding available homes that meet your criteria, accompanying you to showings, and negotiating on your behalf. Ask prospective agents key questions to determine if they are the best fit for your needs.

What is a written buyer agreement? In many cases the agent you’ve selected will be required to enter into a written buyer agreement with you before you tour a home together. This agreement will outline the services the agent will provide and what they will be paid for those services. These agreements are fully negotiable, and you should feel empowered to advocate for the agreement that meets your needs.

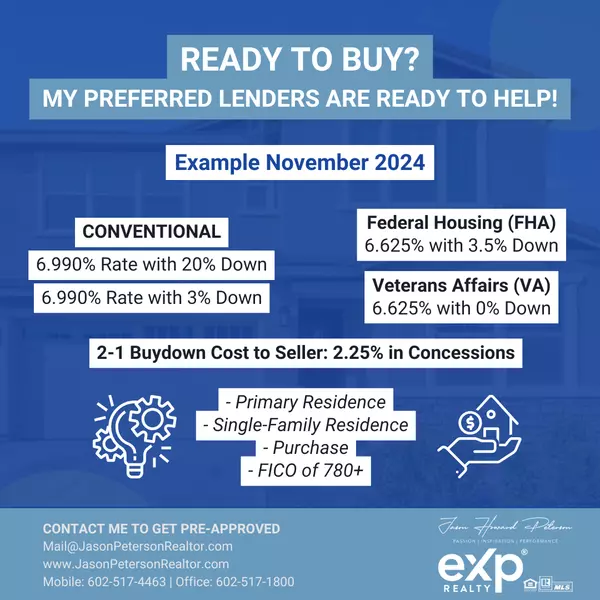

What are my options for securing financing assistance? First-time homebuyers have multiple options for financing the purchase of their first home. Discuss with your agent the programs that might be available to you, including:

📃 Conventional mortgage loans are financed by private lenders, such as banks, credit unions, and mortgage companies. Mortgages typically require a down payment—you can use this tool to find down payment and closing cost assistance programs that you may be eligible for.

📃 Federal loan programs are available for eligible buyers through the Federal Housing Administration, Department of Veterans Affairs, and U.S. Department of Agriculture.

📃 State-funded grants for first-time homebuyers may be an option depending on your location. Contact your state’s housing financing agency for more information.

📃 Local governments or non-profit organizations in your area may have programs available to borrowers that meet specific requirements.

Are there other ways I can lessen my cost burden? Some sellers may offer to pay certain costs associated with purchasing a home for you, which are called concessions. You can also ask the seller to pay for your agent’s compensation as part of your purchase offer. Both are options that may reduce out-of-pocket and upfront expenses, helping you stretch your budget further. Your agent can advocate for you during purchase negotiations on these and other terms.

What other resources are available? Agents who are REALTORS® and your state and local REALTOR® Associations can direct you to many other resources. For example, first-time homebuyers should consider homeownership education and counseling services, which provide tools and information to help resolve financial roadblocks, develop a budget, and work on a plan to meet the financial requirements of homeownership. Your agent can refer you to a HUD certified housing counselor.

How do I know what option is best for me? When you work with an agent who is a REALTOR®, you are working with a professional guided by ethical duties under the REALTOR® Code of Ethics, including the pledge to protect and promote the interests of their clients. Your agent will work with you to weigh your options, answer questions, and develop a strategy you are confident in. You can read more about REALTORS®’ duty to put client interests above their own here.

✅ Please visit facts.realtor for more information and resources, and consult your real estate professional or attorney for details about state law where you are purchasing and/or selling residential real estate.

📣 REALTORS® are members of the National Association of REALTORS®

📚 Welcome to the Future of Residential Real Estate (Commissions Decoupled)

📚 Then and Now: Decoupled Commission and New Flow of Compensation

📚 Homebuyers: Here's What the NAR Settlement Means for You

📚 Home Sellers: Here's What the NAR Settlement Means for You

📚 Then and Now: Decoupled Commission and New Flow of Compensation

📚 Homebuyers: Here's What the NAR Settlement Means for You

📚 Home Sellers: Here's What the NAR Settlement Means for You

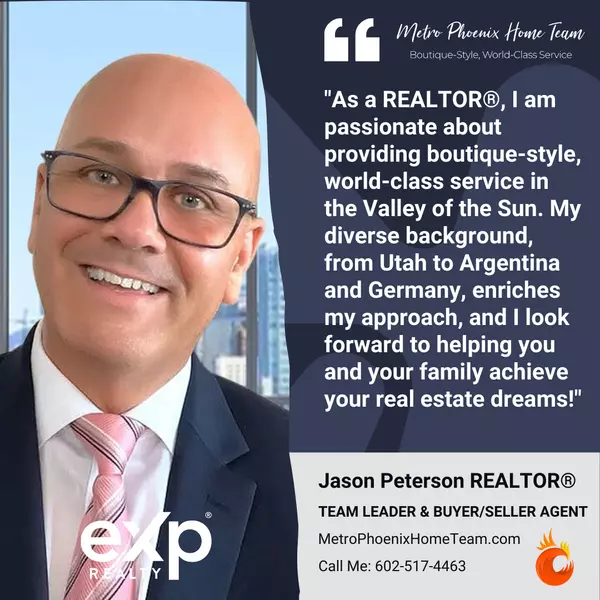

📆 Schedule time with me to address any questions and concerns about buying, selling, and renting residential real estate in the Valley of the Sun (Metro Phoenix). 🏠 We'll get you where you need to go! 🚀

Categories

- All Blogs (896)

- Calculators & Financing (13)

- Certifications & Designations (34)

- Client Reviews & Testimonials (64)

- Do you need a REALTOR®? (59)

- eXp Realty (9)

- FAQs, Tips & Tutorials (246)

- From our Family to Yours (37)

- Home Valuation (42)

- Homebuyer (195)

- Homeowner & Home Seller (133)

- I'm Your ABR (92)

- Jason Howard Peterson (98)

- Landlord & Tenant (69)

- Listed, Leased & Sold (89)

- Market Watch: Reports & Trends (202)

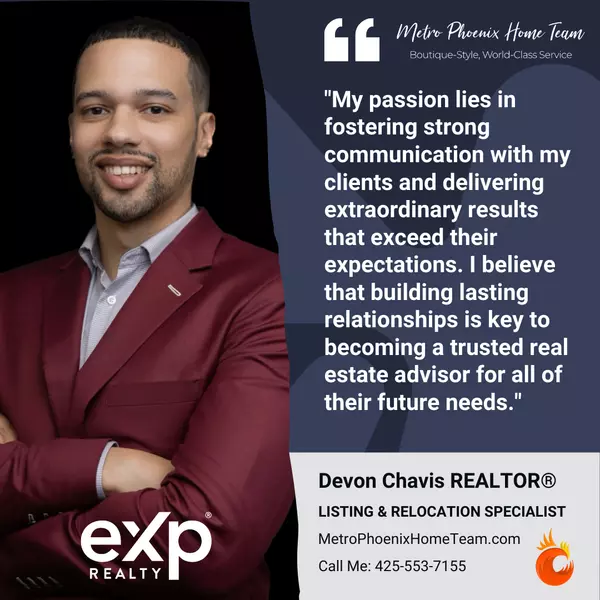

- Meet Your Agent (38)

- NAR Changes/Updates (34)

- Valley of the Sun (55)

Recent Posts

Metro Phoenix Home Team Welcomes Mrs. Payton Kelnhofer

NAR Consumers: Mortgages and Financing

Get Pre-Qualified and Pre-Approved Today!

NAR Consumers: Questions to Ask a Seller’s (Listing) Agent

NAR Consumers: Questions to Ask a Buyer’s (Selling) Agent

NAR Consumers: Buying Your First Home

Metro Phoenix Home Team Welcomes Mrs. Angela Wantink

Metro Phoenix Home Team: Jason Peterson & Associates

Metro Phoenix Home Team Welcomes Mr. Devon Chavis

Satisfied Client: Brett Tolpa

GET MORE INFORMATION