FAQs: How much are standard seller closing costs?

📣 As previously mentioned, each transaction is unique as are the needs of each seller and buyer. When you hire me to list, and get your home sold in concert with a buyer agent, I will provide you with a Net Sheet which will list out all expected costs – we’ll adjust this as each offer comes through, so you’ll have a quick, and efficient look into your expected costs and ultimately your net proceeds. 🏡 Typically, anywhere from 7-10% of the total purchase price can be expected of which anywhere from 4-6% represents the real estate agent/brokerage’s commission (again, typically half of that is then set aside for the buyer’s agent/brokerage). Other various costs could include the following:

- Title search $150 - $400

- Title insurance (owner’s policy) ca. 0.4% of sale price

- Escrow fee 0.5% of the final sale price

- Prorated property taxes and HOA dues based of course on when you sell

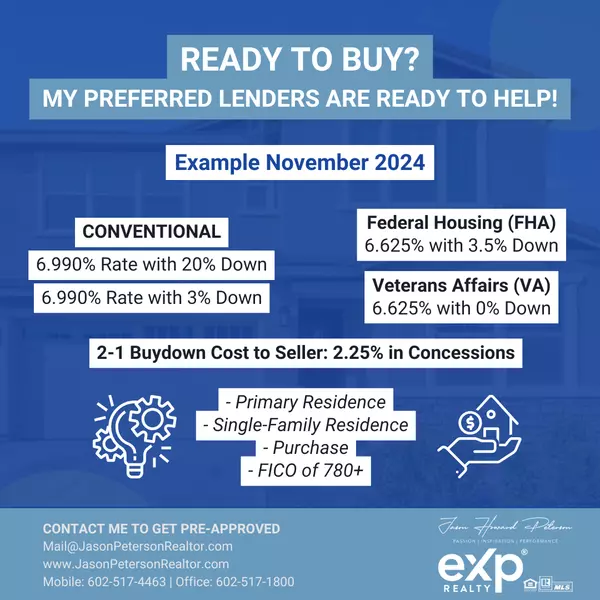

- Buyer’s closing costs you may accept e.g., home warranty, interest rate buydown, other seller concessions

Neither Arizona nor Utah have required real estate transfer taxes due as does e.g., California. ✅

Categories

- All Blogs (896)

- Calculators & Financing (13)

- Certifications & Designations (34)

- Client Reviews & Testimonials (64)

- Do you need a REALTOR®? (59)

- eXp Realty (9)

- FAQs, Tips & Tutorials (246)

- From our Family to Yours (37)

- Home Valuation (42)

- Homebuyer (195)

- Homeowner & Home Seller (133)

- I'm Your ABR (92)

- Jason Howard Peterson (98)

- Landlord & Tenant (69)

- Listed, Leased & Sold (89)

- Market Watch: Reports & Trends (202)

- Meet Your Agent (38)

- NAR Changes/Updates (34)

- Valley of the Sun (55)

Recent Posts

GET MORE INFORMATION