FAQs: What is mortgage insurance?

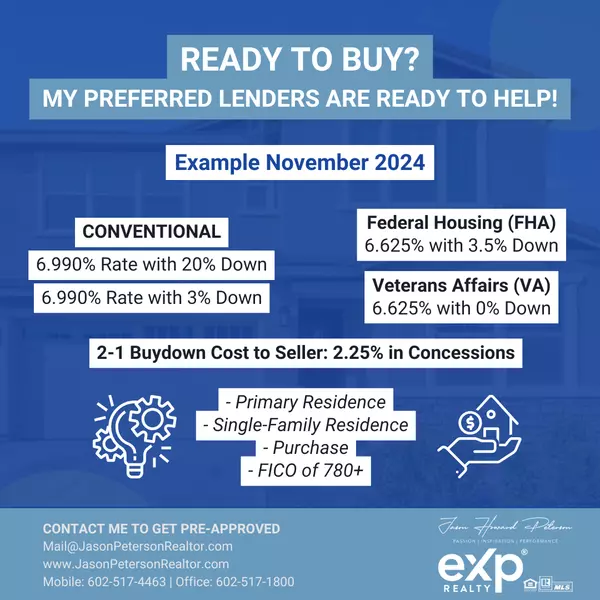

📣 Private Mortgage Insurance (PMI) applies to conventional loans and is required if the buyer has less than a 20% down payment. Monthly Mortgage Insurance (MMI) applies to most single-family mortgages insured by the FHA, which are financed through an insurance fund called the Mutual Mortgage Insurance Fund (MMI Fund). MMI is required if the buyer has less than a 10% down payment. 🏡 FHA’s mortgage insurance (MMI) is much more expensive than PMI for conventional loans. PMI rates and premiums are dependent on a borrower’s credit score and loan-to-value (LTV) ratio compared to FHA’s MMI. The cost of PMI is about 0.2% - 1.9% of the loan amount per year. ✅ 🎬 Taking Your Home to Market🎬 Why You Need an ABR® for Your Next Home Search🎬 I'm Your ABR® - FAQs for Buyers in Metro Phoenix ☎️ Mobile 602-517-4463📧 mail@jasonpetersonrealtor.com🌐 ArizonaMarketWatch.com🌐 UtahMarketWatch.com

FAQs: What is title insurance?

📣 Title insurance is typically required as part of the closing costs. It covers research into public records to ensure that the title is free and clear. For current homeowners, title insurance (owner’s policy) protects them from claims against their property which happened before they purchased, such as a prior owner’s failure to pay taxes or contractors. Title insurance will cover legal fees and/or title disputes which may come up during the time they own the home. 🏡 In addition to the owner’s policy, there’s also a second kind of title insurance for the lender (lender’s policy) which is typically required when selling a home to a buyer who intends on financing. This lender policy (title insurance) will protect the lender from any claims made on the property the buyer is purchasing/financing. An owner’s policy of title insurance is optional, but paying for it once will protect from unexpected issues with the property’s title during the time that they own the home. Purchasing both policies is a good idea and may also be a requirement. The total cost for both is ca. 0.5-1.0% of the purchase price. ✅ 🎬 Taking Your Home to Market🎬 Why You Need an ABR® for Your Next Home Search🎬 I'm Your ABR® - FAQs for Buyers in Metro Phoenix ☎️ Mobile 602-517-4463📧 mail@jasonpetersonrealtor.com🌐 ArizonaMarketWatch.com🌐 UtahMarketWatch.com

FAQs: What is a Lien Theory state and a Title Theory state?

📣 Recording the Deed of Trust provides constructive, public notice that the property has been encumbered. Arizona and Utah are "Title Theory" states and not "Lien Theory" states which means that the lender retains title rights to the property and allows you, the borrower, to occupy the residence as if you own it. 🏡 The lender holds title to the property in the name of you, the borrower, through the Deed of Trust. Once you have paid off your loan is when you receive the Deed of Reconveyance transferring the property’s title from the lender to you the (now previous) borrower. ✅ 🎬 Taking Your Home to Market🎬 Why You Need an ABR® for Your Next Home Search🎬 I'm Your ABR® - FAQs for Buyers in Metro Phoenix ☎️ Mobile 602-517-4463📧 mail@jasonpetersonrealtor.com🌐 ArizonaMarketWatch.com🌐 UtahMarketWatch.com

Categories

- All Blogs (896)

- Calculators & Financing (13)

- Certifications & Designations (34)

- Client Reviews & Testimonials (64)

- Do you need a REALTOR®? (59)

- eXp Realty (9)

- FAQs, Tips & Tutorials (246)

- From our Family to Yours (37)

- Home Valuation (42)

- Homebuyer (195)

- Homeowner & Home Seller (133)

- I'm Your ABR (92)

- Jason Howard Peterson (98)

- Landlord & Tenant (69)

- Listed, Leased & Sold (89)

- Market Watch: Reports & Trends (202)

- Meet Your Agent (38)

- NAR Changes/Updates (34)

- Valley of the Sun (55)

Recent Posts