Which type of loan did you choose for your first home?

Are you familiar with the types of home loans available? 🏠

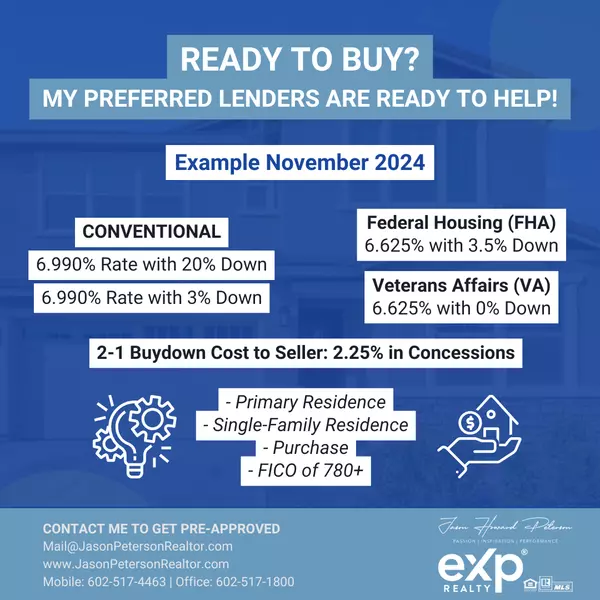

1️⃣ FHA Loan: Insured by the Federal Housing Administration. Pros: Low down payment requirement (as low as 3.5%). Accessible for borrowers with lower credit scores. Competitive interest rates. Cons: Mortgage insurance premiums required. Property restrictions apply. Higher upfront costs.

2️⃣ Conventional Loan: Backed by private lenders. Pros: Flexible terms and options. No upfront mortgage insurance premiums. Can be used for primary residences, second homes, or investment properties. Cons: Typically requires higher credit scores and larger down payments. Stricter qualification criteria.

3️⃣ VA Loan: Available to eligible veterans and service members. Pros: No down payment required for eligible veterans and service members. Competitive interest rates. No private mortgage insurance. Cons: Limited to eligible veterans, active-duty service members, and certain spouses. Funding fee may apply.

4️⃣ USDA Loan: For homes in eligible rural areas. Pros: No down payment required for eligible rural and suburban homebuyers. Low interest rates. No private mortgage insurance. Cons: Limited to specific rural and suburban areas. Income limits apply. Property eligibility criteria.

📆 Schedule time with me to address any questions and concerns about buying and selling residential real estate in the Valley of the Sun (Metro Phoenix). 🏠 We'll get you where you need to go! 🚀

Categories

- All Blogs (896)

- Calculators & Financing (13)

- Certifications & Designations (34)

- Client Reviews & Testimonials (64)

- Do you need a REALTOR®? (59)

- eXp Realty (9)

- FAQs, Tips & Tutorials (246)

- From our Family to Yours (37)

- Home Valuation (42)

- Homebuyer (195)

- Homeowner & Home Seller (133)

- I'm Your ABR (92)

- Jason Howard Peterson (98)

- Landlord & Tenant (69)

- Listed, Leased & Sold (89)

- Market Watch: Reports & Trends (202)

- Meet Your Agent (38)

- NAR Changes/Updates (34)

- Valley of the Sun (55)

Recent Posts

Metro Phoenix Home Team Welcomes Mrs. Payton Kelnhofer

NAR Consumers: Mortgages and Financing

Get Pre-Qualified and Pre-Approved Today!

NAR Consumers: Questions to Ask a Seller’s (Listing) Agent

NAR Consumers: Questions to Ask a Buyer’s (Selling) Agent

NAR Consumers: Buying Your First Home

Metro Phoenix Home Team Welcomes Mrs. Angela Wantink

Metro Phoenix Home Team: Jason Peterson & Associates

Metro Phoenix Home Team Welcomes Mr. Devon Chavis

Satisfied Client: Brett Tolpa

GET MORE INFORMATION