Use the 2-1 Buydown to Access a Lower Interest Rate

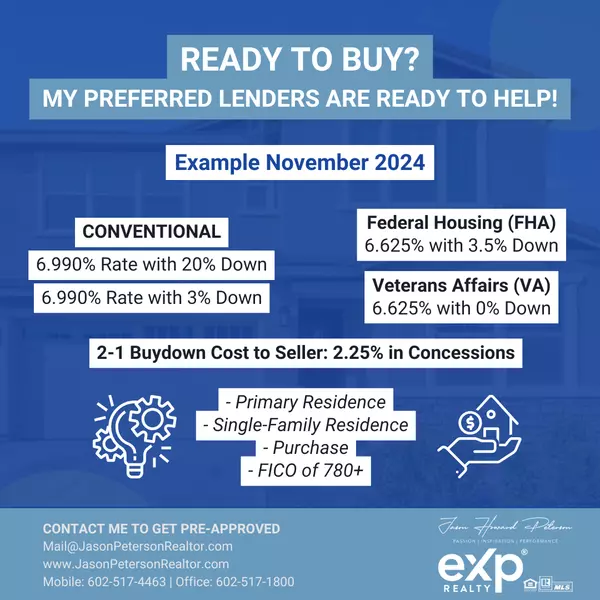

📣 A 2/1 Buydown is just one type of program for buyers to access and secure a lower interest rate and payment for the first two years of their home loan. Typically, a seller will pay some interest up front so the buyer can enjoy a rate that's 2% lower in the first year and 1% lower in the second year.

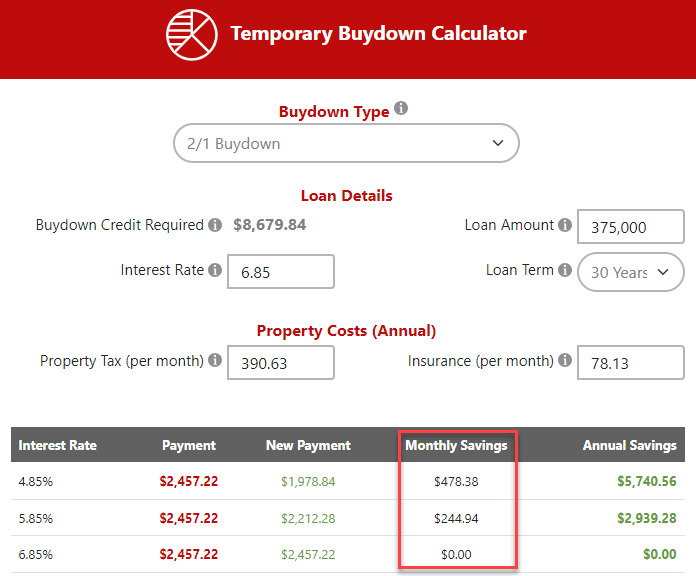

💰 With a 2/1 Buydown, your mortgage interest rate will be discounted by 2% during the first full year of your loan and by 1% the next year. The seller or builder typically pays the costs. Access the 2/1 Buydown Calculator to see how this special loan program might work for your scenario and reach out if you would like to learn more.

🧮 In a conventional 2/1 Buydown, a lender may calculate the exact amount of interest saved in years 1 and 2 to establish as the upfront cost of the buydown. The funds for the buydown are held in an escrow account and applied with each regular payment to bring it up to the full amount otherwise due. Buydown costs paid by a seller may still be deductible as points/pre-paid interest by the borrower, but always check with your tax professional for applicability in your scenario.

📝 Here's a calculator you can use to help you see the difference a 2/1 Buydown can make in a home purchase. 🏡 You'll see how this strategy will deliver much more than just a lower monthly payment. There may be other options available that are better suited to your needs. Please contact me with any questions, so I can connect you with one of my preferred loan officers. 🙋♂️

🤔 Can a 2/1 Buydown Help Me to Access a Lower Interest Rate?

☎️ 602-517-4463📧 Mail@JasonPetersonRealtor.com

🌐 JasonPetersonRealtor.com

Categories

- All Blogs (897)

- Calculators & Financing (13)

- Certifications & Designations (34)

- Client Reviews & Testimonials (64)

- Do you need a REALTOR®? (59)

- eXp Realty (9)

- FAQs, Tips & Tutorials (247)

- From our Family to Yours (37)

- Home Valuation (42)

- Homebuyer (196)

- Homeowner & Home Seller (133)

- I'm Your ABR (92)

- Jason Howard Peterson (98)

- Landlord & Tenant (69)

- Listed, Leased & Sold (89)

- Market Watch: Reports & Trends (202)

- Meet Your Agent (38)

- NAR Changes/Updates (35)

- Valley of the Sun (55)

Recent Posts

GET MORE INFORMATION