Loan Level Price Adjustments (LLPAs)

📣 We can’t blame interest rates for this one! 📈 Loan Level Price Adjustments (LLPAs) are increasing for many mortgages this spring.* LLPAs are fees the government mortgage entities set relative to the nature and potential risk in different loan scenarios. More risk means higher costs, and these costs are passed to borrowers in the form of higher rates or points. 💰

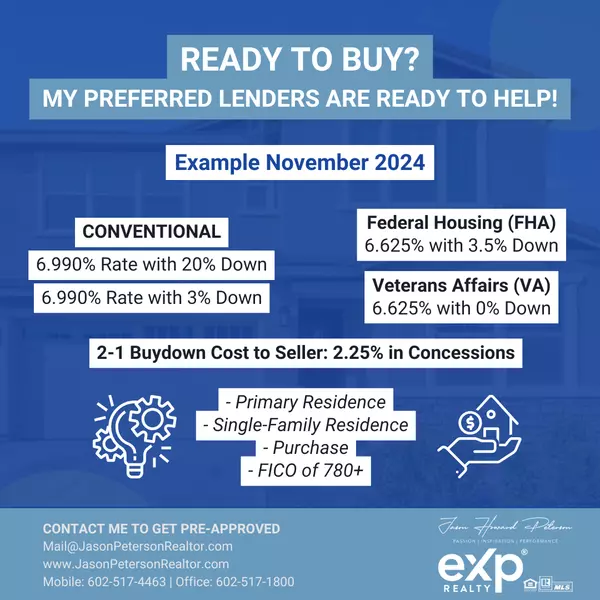

The changes my preferred lender Matthew Kelchner at Rocket Mortgage expects to most impact our clients are higher costs for:

- Cash-out refinances

- Borrowers with high debt to income ratios

- Loans with smaller down payments

- Multi-family or investment property financing

One piece of good news is that temporary fee adjustments that help first-time borrowers and low-to-moderate income borrowers will now be permanent! 🏡

What should you do?

If you’re thinking of a purchase or refinance this year, please reach out to my preferred lender 🙋♂️ Matthew Kelchner at Rocket Mortgage to see if the fee changes may impact your scenario. Matthew can weigh the potential costs and benefits of acting before these changes occur; he's ready to help when you're ready. 💪

* Fannie Mae and Freddie Mac are instituting the changes for loans purchased by them as of May 1, 2023.

☎️ 602-517-4463📧 Mail@JasonPetersonRealtor.com

🌐 JasonPetersonRealtor.com

Categories

- All Blogs (897)

- Calculators & Financing (13)

- Certifications & Designations (34)

- Client Reviews & Testimonials (64)

- Do you need a REALTOR®? (59)

- eXp Realty (9)

- FAQs, Tips & Tutorials (247)

- From our Family to Yours (37)

- Home Valuation (42)

- Homebuyer (196)

- Homeowner & Home Seller (133)

- I'm Your ABR (92)

- Jason Howard Peterson (98)

- Landlord & Tenant (69)

- Listed, Leased & Sold (89)

- Market Watch: Reports & Trends (202)

- Meet Your Agent (38)

- NAR Changes/Updates (35)

- Valley of the Sun (55)

Recent Posts

GET MORE INFORMATION