Lender Required Repairs: What Are They?

What is the difference between a Home Inspection, and the Appraiser’s Inspection?

Before we begin clarifying which repairs may be required by the lender when purchasing residential real estate, let’s cover some (not all) high-level standard processes and steps with resale transactions when financing is involved focusing on the Home Inspection (Due Diligence Contingency) and Residential Appraisal Report (Appraisal Contingency) with or without lender required repairs.

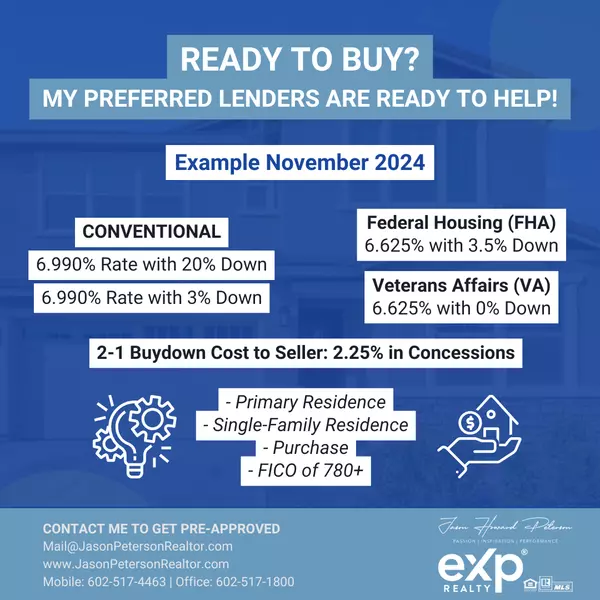

🪜 You find the home you want to purchase (with an FHA loan and a 3.5% down payment) and go under contract with the seller. Congratulations!

🪜 You and your agent open escrow at a title agency (company) scheduled to close escrow in 45 days.

🪜 With the first ten-days of Due Diligence (the first contingency), you hire a home inspector to perform a thorough inspection of the home, the pool, checking for termite damage (Wood-Destroying Insect Inspection Report), as well as a sewer scope. You pay for the home inspection out-of-pocket (outside of escrow).

🪜 The home inspection shows that the roof’s underlayment is intact but nearing the end of its life, so you come to an agreement with the seller to receive $8,000 in concessions to help pay for the future required repairs estimated at $16,000.

🪜 Once the home inspection (Due Diligence) is wrapped up and both parties are ready to move forward (signing off with the BINSR and Addendum addressing the credit in lieu of repairs), the appraiser is ordered by your lender, which you’ll pay for through the settlement statement at the close of escrow.

🪜 The appraiser performs his/her inspection and delivers a Residential Appraisal Report, which is $10,000 below the agreed upon purchase price so, you come to an agreement with the seller to have the purchase price lowered from $485,000 to $475,000 (keeping the $8,000 in concessions intact).

🪜 The Residential Appraisal Report delivered (reconciliation section*) will either indicate As-Is, Subject to Completion, or Subject to the Following Repairs. We’ll assume that the latter is selected by the appraiser, indicating that the horizontal cracks in the stem wall from the foundation must be addressed prior to close of escrow, as well as the outdated electrical panel in dire need of being replaced. The seller agrees to have both issues corrected prior to the closing of escrow at their own expense.

🪜 Prior to the closing of escrow, the issues previously addressed in the Residential Appraisal Report are inspected once again to confirm both having been properly addressed.

🪜 Now that the Appraisal Contingency has been resolved the lender reviews all details once again (with the buyer’s loan) to confirm that the Loan Contingency (the 3rd and last contingency) has been tackled.

🪜 The buyer and seller documents are signed and notarized, and the lender funds the loan – close of escrow can now take place.

* Residential Appraisal Report – Reconciliation

As-Is: Typically refers to the property being valued in its current condition without any repairs, renovations, or improvements being made. When an appraiser uses the "As-Is" designation, they are indicating that they have assessed the property based on its current state, taking into account any observable defects or necessary repairs.

💡 This designation is important for potential buyers, sellers, and lenders to understand the property's value in its existing condition, without factoring in any potential future enhancements.

💡 This designation is important for potential buyers, sellers, and lenders to understand the property's value in its existing condition, without factoring in any potential future enhancements.

Subject to Completion: Typically refers to the property being valued based on the assumption that certain specified repairs, renovations, or improvements will be completed before the final valuation. When an appraiser uses the "Subject to Completion" designation, they are indicating that the property's value is contingent on the completion of identified work, which might enhance the property's condition or value.

💡 This designation is important for potential buyers, sellers, and lenders to understand how the property's value may change after the specified improvements are made.

💡 This designation is important for potential buyers, sellers, and lenders to understand how the property's value may change after the specified improvements are made.

Subject to the Following Repairs: Indicates that the property's value is contingent on the completion of specific repairs or improvements identified by the appraiser. These repairs are outlined in the report and may include necessary fixes to address safety hazards, structural issues, or other concerns that impact the property's value. The appraiser notes that the property's final valuation is subject to these repairs being completed, and the value may be adjusted based on the cost and extent of the required repairs.

💡 This designation helps potential buyers, sellers, and lenders understand the condition of the property and the implications of the necessary repairs on its value.

💡 This designation helps potential buyers, sellers, and lenders understand the condition of the property and the implications of the necessary repairs on its value.

In a perfect world, the home inspection report will be squeaky clean, and the appraisal will come back with a home’s value meeting or exceeding the purchase price without any lender required repairs. Unfortunately, this is rarely the case. Home inspectors generally find some routine and minor defects that the buyer will willingly assume, however, sometimes inspections will reveal major structural defects and safety violations. Common defects found during home inspections may be as follows:

🏡 Roofing Defects: Age, wear, and improper installation.

🏡 Ceiling Stains: Point toward active or past issues with leaking roofs, plumbing, or appliances.

🏡 Water Intrusions: Particularly in basements – improper drainage around the house.

🏡 Electrical Safety Hazards: Old, ungrounded outlets, non-GFI (ground fault interrupter) outlets, improperly wired panels, outdated wiring.

🏡 Rotten Wood: Commonly on trim, roof eaves, and decks.

🏡 Building Code Violations: Unpermitted structures/additions, safety issues, do-it-yourself projects gone wrong.

🏡 Unsafe Fireplace and Chimney Conditions: Insufficient distance between fireplace and combustible materials, lack of chimney cleaning and maintenance.

🏡 Minor Plumbing Defects: Loose toilets, leaking faucets, improper drainage.

🏡 Failed Seals from Windows: Sealant or gasket has deteriorated or broken down, allowing air, moisture, or condensation to enter between the panes.

Lender required repairs, also known as lender-specified repairs.

These are any repairs or improvements that a lending institution mandates before approving a loan application for a property purchase. When you're applying for a mortgage or another type of loan to buy a property, the lender may require certain repairs to be completed before they provide the funds. This is to ensure that the property meets their standards and is in acceptable condition.

The specific repairs can vary depending on the lender's guidelines, but typically they focus on issues that may affect the property's value or pose a risk to the borrower's investment. It's important to carefully review and understand the lender's repair requirements before proceeding with the loan application.

How do lenders determine the need for repairs?

Lenders typically determine the need for repairs by conducting a property appraisal and home inspection conducted by an independent and unbiased appraiser. During the appraisal, a professional appraiser assesses the value of the property based on several factors, including its condition. They evaluate the overall condition of the property, taking note of any visible repairs or issues.

Additionally, lenders often require a home inspection, which is conducted by a qualified inspector. The inspector thoroughly examines the property's structure, systems, and components, and identifies any defects, safety hazards, or necessary repairs. This inspection helps lenders understand the extent of repairs needed and their potential impact on the property's value.

Based on both the appraisal and home inspection reports, lenders then determine whether repairs are necessary. If significant repairs are required, they may request that the repairs be completed before approving a loan. In some cases, lenders can also set aside funds in an escrow account to cover the cost of repairs, which are released once the repairs are completed.

It's important to note that the specific criteria for determining the need for repairs may vary among different lenders and loan programs. It's best to consult with your lender directly to understand their specific requirements.

Does a seller have to make repairs?

Whether a seller must make repairs depends on various factors, including local laws, contract negotiations, and the specific terms of the sale. In some cases, sellers may be obligated to make certain repairs, while in others, they have no obligation to do so.

Some real estate contracts include a "seller's disclosure" or "as-is" clause, which can affect the seller's responsibility for repairs. A seller's disclosure typically requires the seller to disclose known defects or issues with the property, but it doesn't necessarily mean they have to fix them. On the other hand, an "as-is" clause indicates that the property is being sold in its current condition, and the seller typically won't undertake repairs.

However, negotiations between the buyer and seller can play a significant role in determining whether repairs are made. Buyers may request repairs as part of their offer or during the inspection period. Sellers can choose to accept the request, negotiate repairs, offer a credit instead of making repairs, or decline the request altogether. The outcome depends on the parties' willingness to compromise and the specifics of the situation.

If you're considering selling or buying a property, it's advisable to consult with a real estate professional or attorney who can provide guidance based on your specific circumstances and local regulations.

What are FHA required repairs?

FHA (Federal Housing Administration) required repairs are specific repairs that may be required by the FHA for homes backed by FHA-insured loans. These repairs are intended to ensure the safety, habitability, and marketability of the property.

The FHA has specific guidelines that outline the minimum property standards, and if a home does not meet these standards, certain repairs may need to be made before the loan can be approved. The required repairs can vary depending on the condition of the property, but they generally address issues that impact the health, safety, or structural integrity of the home, such as faulty electrical systems, broken plumbing, or significant structural damage.

🧰 Unpainted downspouts and broken rain gutters

🧰 Decaying outbuildings in need of demolition

🧰 Exterior doors that do not properly open and close

🧰 Exposed wiring and uncovered junction boxes

🧰 Significant plumbing problems and leaks

🧰 Non-functioning HVAC systems

🧰 Leaking or faulty roofs

🧰 Roofs nearing end-of-life

🧰 Active and visible pest infestations

🧰 Deteriorating windowsills, eaves, or support columns on a porch

🧰 Missing appliances typically included when selling a home

🧰 Bedrooms lacking windows of minimum size for egress or windows with bars that do not release

🧰 Foundation or structural issues

🧰 Damp areas

🧰 Non-functioning kitchen appliances

🧰 Empty swimming pools, pools without functioning pumps, and abandoned pools

🧰 Torn window screens

🧰 Lack of a pressure relief valve on the water heater

🧰 Leaning or broken fences

🧰 Decaying outbuildings in need of demolition

🧰 Exterior doors that do not properly open and close

🧰 Exposed wiring and uncovered junction boxes

🧰 Significant plumbing problems and leaks

🧰 Non-functioning HVAC systems

🧰 Leaking or faulty roofs

🧰 Roofs nearing end-of-life

🧰 Active and visible pest infestations

🧰 Deteriorating windowsills, eaves, or support columns on a porch

🧰 Missing appliances typically included when selling a home

🧰 Bedrooms lacking windows of minimum size for egress or windows with bars that do not release

🧰 Foundation or structural issues

🧰 Damp areas

🧰 Non-functioning kitchen appliances

🧰 Empty swimming pools, pools without functioning pumps, and abandoned pools

🧰 Torn window screens

🧰 Lack of a pressure relief valve on the water heater

🧰 Leaning or broken fences

It's important to note that these repair requirements are specific to FHA loans and may not be required for conventional loans.

What are VA lender required repairs?

VA lender required repairs refer to specific repairs or improvements that may be required by a lender to ensure the property meets the standards set by the Department of Veterans Affairs (VA). These requirements are typically outlined in the VA's Minimum Property Requirements** (MPRs).

When a borrower applies for a VA loan to finance the purchase of a property, the lender will need to assess the property's condition to ensure it meets the MPRs. These requirements focus primarily on the safety, health, and habitability of the home.

Some common examples of VA lender required repairs could include fixing a leaky roof, addressing plumbing or electrical issues, repairing structural damage, correcting safety hazards, or ensuring the presence of functioning heating and cooling systems.

It's important to note that the VA lender required repairs are distinct from the typical repairs a seller might agree to make as part of negotiations. These repairs are specifically mandated by the lender to protect the interests of the borrower and ensure the property meets the VA loan requirements.

** VA's Minimum Property Requirements (MPRs)

The Minimum Property Requirements (MPRs) refer to the specific standards set by the Department of Veterans Affairs (VA) for properties that are eligible for VA-backed home loans. These requirements ensure that the properties are safe, structurally sound, and meet certain health and sanitary standards.

The MPRs cover various aspects of the property, including foundation integrity, roof condition, electrical and plumbing systems, heating and cooling systems, and overall structural soundness. The goal is to ensure that veterans who use VA loans to purchase homes are not burdened with significant repairs or maintenance costs.

If a property does not meet the VA's MPRs, it does not necessarily mean that the loan won't be approved. In such cases, the VA may require specific repairs or improvements to be made before the loan can be approved. Additionally, the VA may also provide financing for certain qualifying improvements through the VA Energy Efficient Mortgage program.

It's important for homebuyers and sellers to be aware of the MPRs when using VA loans, as non-compliance with these requirements can affect the loan approval process. If you have any specific questions about the MPRs or any other topic related to VA loans, feel free to contact me, so I can connect you with my preferred VA loan officer.

Do conventional loans have lender required repairs?

Yes, conventional loans can have lender required repairs. When you apply for a conventional loan, the lender will typically conduct an appraisal to assess the value of the property. During this appraisal, if any significant issues or safety concerns are identified, the lender may require repairs to be completed before approving the loan.

These repairs are typically necessary to ensure that the property meets minimum standards and is in good condition. Examples of common lender-required repairs can include fixing structural issues, replacing a faulty roof, updating electrical or plumbing systems, or correcting safety hazards. The specific repairs required will vary depending on the lender and the condition of the property being financed.

It's essential to work closely with your lender and real estate agent to understand any repair requirements and ensure a smooth loan approval process.

How can one avoid lender required repairs?

When it comes to avoiding lender required repairs, there are a few things you can keep in mind. Here are some tips:

✅ Conduct a thorough inspection: To ultimately secure financing, make sure to have a comprehensive inspection done on the property. This will help you identify any potential issues beforehand, allowing you to address them before the lender's appraisal.

✅ Handle necessary repairs in advance: If the inspection reveals any necessary repairs, it's best to take care of them (sellers are encouraged to conduct a home inspection prior to listing on the open market). This will prevent the lender from identifying these issues during their appraisal and potentially requiring repairs as a condition for financing.

✅ Keep the property well-maintained: Regular maintenance is crucial in preventing the deterioration of your property. By staying on top of repairs and maintenance tasks, you can minimize the chances of major problems arising that could prompt lender-required repairs.

✅ Choose a reputable lender: Different lenders may have varying requirements and stipulations. It's important to research and select a reputable lender who is known to be less stringent with repair demands. Working with a lender who understands the property's condition and your plans can help avoid unnecessary repair obligations.

✅ Negotiate terms and contingencies: When negotiating terms with the lender or during the purchase agreement, it's worth discussing any potential repair contingencies. Clarify what types of repairs may be expected and negotiate to have them addressed between the buyer and seller.

✅ Consult with professionals: If you're uncertain about how to proceed or want expert advice, consider consulting with professionals such as real estate agents, contractors, or attorneys. Their experience and knowledge can provide insights on navigating lender-required repairs more effectively.

Remember, each situation may be unique, and it's vital to communicate openly with your lender and seek appropriate professional guidance for your specific circumstances.

I always and strongly encourage all my seller clients to perform a home inspection prior to listing a home for sale on the open market to be completely certain that all major issues are known and/or corrected upfront – a couple hundred dollars that can avoid future misunderstandings and unexpected seller concessions to buyers.

📆 Schedule time with me to address any of your concerns. I am looking forward to meeting you soon or sometime soon again and until then, I wish you and your family only the very best. Take care!

Categories

- All Blogs (896)

- Calculators & Financing (13)

- Certifications & Designations (34)

- Client Reviews & Testimonials (64)

- Do you need a REALTOR®? (59)

- eXp Realty (9)

- FAQs, Tips & Tutorials (246)

- From our Family to Yours (37)

- Home Valuation (42)

- Homebuyer (195)

- Homeowner & Home Seller (133)

- I'm Your ABR (92)

- Jason Howard Peterson (98)

- Landlord & Tenant (69)

- Listed, Leased & Sold (89)

- Market Watch: Reports & Trends (202)

- Meet Your Agent (38)

- NAR Changes/Updates (34)

- Valley of the Sun (55)

Recent Posts

Metro Phoenix Home Team Welcomes Mrs. Payton Kelnhofer

NAR Consumers: Mortgages and Financing

Get Pre-Qualified and Pre-Approved Today!

NAR Consumers: Questions to Ask a Seller’s (Listing) Agent

NAR Consumers: Questions to Ask a Buyer’s (Selling) Agent

NAR Consumers: Buying Your First Home

Metro Phoenix Home Team Welcomes Mrs. Angela Wantink

Metro Phoenix Home Team: Jason Peterson & Associates

Metro Phoenix Home Team Welcomes Mr. Devon Chavis

Satisfied Client: Brett Tolpa

GET MORE INFORMATION