Can I use my 401(k) to purchase a home?

Considering using your 401(k) to buy a home? 🏠 Here’s what you need to know! 💡

💰 Access to Funds: Provides immediate access to a large sum for your down payment and/or closing costs.

🚫 Avoid PMI: If the withdrawal helps you reach a 20% down payment, you can avoid private mortgage insurance (PMI).

💸 Taxes & Penalties: Early withdrawals (before age 59½) may incur taxes and a 10% penalty.

📉 Reduced Retirement Savings: Depletes your retirement fund, impacting your future financial security.

⏰ Loan Repayment Risks: If you take a loan against your 401(k) and leave your job, the loan must be repaid quickly to avoid penalties.

Think it through and consult a financial advisor! You may be able to use funds from your 401(k) to purchase a home under certain circumstances. Here are a few options to consider:

401(k) loan: Some 401(k) plans allow you to borrow funds from your account for specific purposes, including purchasing a home. The maximum amount you can borrow is typically 50% of your vested balance, up to a maximum of $50,000. You must repay the loan, including interest, within a specified time frame, usually five years.

Hardship withdrawal: In some cases, you may be able to take a hardship withdrawal from your 401(k) to use for the down payment or other home buying expenses. However, this option typically comes with strict eligibility criteria and tax implications, including a 10% early withdrawal penalty if you are under age 59 ½.

Employer-sponsored programs: Some employers offer homeownership assistance programs that allow employees to withdraw funds from their 401(k) for the purchase of a primary residence. These programs may have specific rules and restrictions, so it's essential to check with your employer for details.

While using your 401(k) funds for a home purchase can be a viable option, it's crucial to consider the potential drawbacks, such as reducing your retirement savings, incurring taxes and penalties, and potentially missing out on investment growth. Before making any decisions, it's advisable to consult with a financial advisor or tax professional to understand the implications and explore other financing options available to you.

📆 Schedule time with me to address any questions and concerns about buying and selling residential real estate in the Valley of the Sun (Metro Phoenix). 🏠 We'll get you where you need to go! 🚀

Categories

- All Blogs (896)

- Calculators & Financing (13)

- Certifications & Designations (34)

- Client Reviews & Testimonials (64)

- Do you need a REALTOR®? (59)

- eXp Realty (9)

- FAQs, Tips & Tutorials (246)

- From our Family to Yours (37)

- Home Valuation (42)

- Homebuyer (195)

- Homeowner & Home Seller (133)

- I'm Your ABR (92)

- Jason Howard Peterson (98)

- Landlord & Tenant (69)

- Listed, Leased & Sold (89)

- Market Watch: Reports & Trends (202)

- Meet Your Agent (38)

- NAR Changes/Updates (34)

- Valley of the Sun (55)

Recent Posts

Metro Phoenix Home Team Welcomes Mrs. Payton Kelnhofer

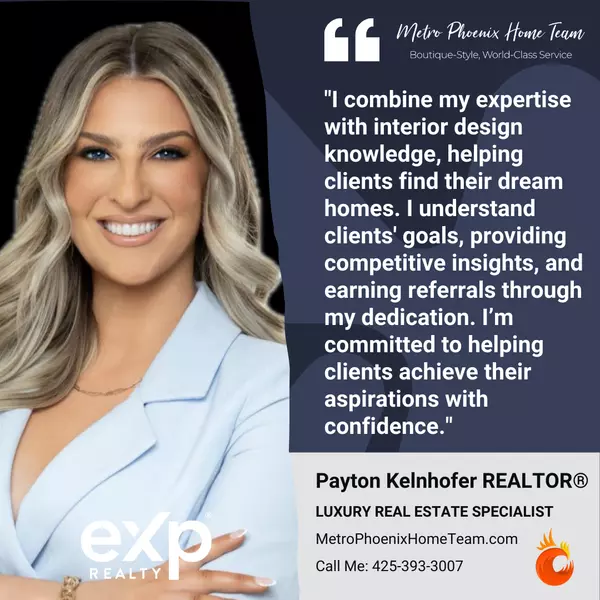

NAR Consumers: Mortgages and Financing

Get Pre-Qualified and Pre-Approved Today!

NAR Consumers: Questions to Ask a Seller’s (Listing) Agent

NAR Consumers: Questions to Ask a Buyer’s (Selling) Agent

NAR Consumers: Buying Your First Home

Metro Phoenix Home Team Welcomes Mrs. Angela Wantink

Metro Phoenix Home Team: Jason Peterson & Associates

Metro Phoenix Home Team Welcomes Mr. Devon Chavis

Satisfied Client: Brett Tolpa

GET MORE INFORMATION