Transfer Process for Leased Solar Panel Installation During a Home Sale

What you need to know about selling your house with a leased solar installation.

First and foremost, it is important to understand that there are buyers who will be happy to discover that you have a solar installation. However, there are also many buyers who do not want a solar installation. What is even more important is that regardless of the buyer's preference, no buyer will be pleased to learn that they will need to take over your loan for the solar installation if it has not been paid off yet.

If you decide to sell your home with a leased solar installation, you can either pay off the loan before listing your home for sale, or you will need to disclose that the solar installation is leased and inform the buyer that they will need to assume the loan. This is facilitated with the Solar Addendum.

If you decide to sell your home to Opendoor, you will need to pay off the balance at the close of escrow. Therefore, you should expect that amount to reduce your net proceeds.

High-level overview when selling your home with a leased solar installation.

When selling a home with leased solar panels, the transfer process typically involves the following steps:

1. Contact the solar panel leasing company: Notify the solar panel leasing company of your intention to sell the home. They will guide you through the process and provide information on transferring the lease to the new homeowner.

2. Obtain necessary documentation: Gather all relevant documentation related to the solar panel lease agreement, including contract details, payment information, and contact information for the leasing company.

3. Inform the buyer: Disclose the presence of the leased solar panels to potential buyers during the home sale process. Provide them with information on the lease terms and transfer process.

4. Transfer lease agreement: Work with the solar panel leasing company to transfer the lease agreement to the new homeowner. This may involve a credit check and approval process for the buyer.

5. Update ownership information: Provide the leasing company with the new homeowner's contact information and ensure that ownership details are updated in their records.

6. Coordinate final steps: Coordinate any final steps required to complete the transfer process, such as signing transfer documents, arranging for a new payment account, and ensuring the new homeowner understands their responsibilities under the lease agreement.

7. Close the sale: Once the transfer process is complete, finalize the sale of the home with the new homeowner, ensuring that all details related to the leased solar panels are accurately reflected in the sale contract.

💡 It's important to consult with the solar panel leasing company early in the home sale process to ensure a smooth and efficient transfer of the lease agreement to the new homeowner.

💡 If the solar panels are leased, the lease agreement may be transferable to the new owner. The seller may need to pay a small processing fee to terminate and refile UCC filings. The new owner should also check with the lender to make sure no additional steps are required.

💡 Uniform Commercial Code (UCC) filings allow creditors to notify other creditors about a debtor's assets used as collateral for a secured transaction. UCC liens filed with Secretary of State offices act as a public notice by the "creditor" of the creditor's interest in the property.

Summarizing the standard process of transferring a solar installation to a new owner based on the sale of your home typically involves the following steps:

1️⃣ The buyer signs an ownership transfer form.

2️⃣ The buyer submits a credit application to the solar company.

3️⃣ The solar company approves the credit application.

4️⃣ The lease is transferred to the new owner.

5️⃣ The new owner agrees to take over the existing payment schedule.

6️⃣ The seller and buyer sign over ownership.

7️⃣ The new owner takes over ACH payments.

8️⃣ The utility provides interconnection approval.

9️⃣ If there is a secured loan, the remaining loan must be settled.

🔟 The transfer of ownership is properly documented with legal documentation, such as a bill of sale or transfer of ownership form.

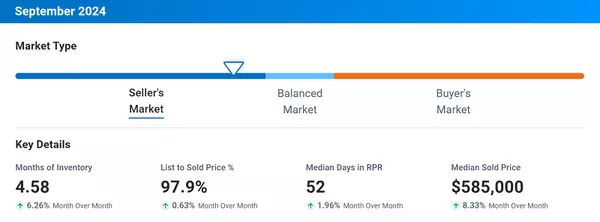

Storyline with considerations and pitfalls based on a real-life example (Metro Phoenix).

The buyers are excited to have finally found the ideal home they have been dreaming of, with a purchase price that meets their expectations. They discover that the home has a large solar installation, which the sellers had installed just a couple of years ago. The MLS listing indicates that the buyer must take over the loan for the leased solar installation.

The listing agent has provided the Solar Addendum disclosing the leased solar installation. This document must be acknowledged and accepted by the buyers if they choose to purchase the home. Additionally, there is an application available for the buyers to complete and submit to the bank. They will need to provide their proof of income, etc., in order for the bank to run a credit check and eventually approve them to assume the loan from the current owners.

Both parties sign the purchase agreement and all related addend and are happy to now be under contract. The buyers agree to submit their documents to the bank to assume the loan for the leased solar installation. The close of escrow is set for 45 days out. A few days later, the bank informs the buyers that the review of their application and solar transfer process may take up to 60 days. However, the bank assures both parties that they will make an effort to review everything within 7-10 business days.

Weeks later, the Assumption Agreement still has not arrived. Both parties (buyer and seller, including their real estate agents) have begun calling the bank and are continuously being informed that underwriting is working on it and to please be patient.

The close of escrow (CoE) date arrives and there is still no Assumption Agreement available. Both parties agree to delay the close of escrow by five days. Two days before the new CoE, after multiple calls and waiting, the Assumption Agreement is finally delivered and signed by both the buyers and the sellers. However, there is an issue - the escrow officer at the title company states that she cannot record without the UCC Termination from the bank, resulting in a "cloud on title". She must clear the title in order to proceed with recording.

Everyone calls the bank again and finds out that the bank will not release the UCC Termination before closing and recording has occurred. They inform us that we need to close and record first, after which they will provide the escrow officer with the UCC Termination. Everyone is now in panic mode, worrying that the close of escrow will be delayed once again, or even worse, not possible at all.

The escrow officer consults with her title company and receives approval that the UCC Termination can be a "To-Come" item, giving us a backup plan in case the bank refuses to give us the UCC Termination required to clear title after closing.

The bank is contacted once again to confirm, and the answer is clear: they will not send the UCC Termination until they have proof of closing and recordation. With the approval for the UCC Termination to be a “To-Come” item, the escrow officer closes escrow and records at the county recorder’s office. The transaction and closing are finally successful after weeks of stress, text messages, emails, and dozens of calls. 🥂

💡 BEST PRACTICE: Be prepared! Speak with the bank first prior to agreeing on a close of escrow date and confirm with your escrow officer whether they can close escrow and record without the UCC Termination available – should that be the case with the bank you’re working with for the Assumption Agreement.

📚 Learn more from AAR®’s Solar Addendum FAQs.

📆 Schedule time with me to address any of your concerns. We’ll get you where you need to go! 🚀

☎️ Mobile 602-517-4463

📧 Mail@JasonPetersonRealtor.com

🌐 JasonPetersonRealtor.com

Categories

- All Blogs (871)

- Calculators & Financing (13)

- Certifications & Designations (34)

- Client Reviews & Testimonials (63)

- Do you need a REALTOR®? (59)

- eXp Realty (8)

- FAQs, Tips & Tutorials (234)

- From our Family to Yours (37)

- Home Valuation (42)

- Homebuyer (186)

- Homeowner & Home Seller (124)

- I'm Your ABR (92)

- Jason Howard Peterson (98)

- Landlord & Tenant (68)

- Listed, Leased & Sold (86)

- Market Watch: Reports & Trends (201)

- Meet Your Agent (31)

- NAR Changes/Updates (22)

- Valley of the Sun (55)

Recent Posts

GET MORE INFORMATION