Selling to a Wholesale Buyer and Investor: Intent to Assign the Purchase Contract Prior to Close of Escrow

What are the risks in selling to a wholesale buyer and investor?

Selling to a wholesale buyer or investor can offer certain advantages, such as a quick sale and cash payment without the need for repairs or staging. However, there are also risks involved in selling to this type of buyer:

1. Lower Sale Price: Wholesale buyers and investors typically look for discounted properties that they can improve and resell for a profit. This means that you may receive a lower sale price than if you were to sell through traditional means.

2. Limited Negotiation Power: Wholesale buyers often set their price and terms, leaving you with limited room for negotiation. This can result in less favorable terms for the seller.

3. Quick Closing: While a quick closing can be beneficial, it may also mean that you have less time to consider offers, review contracts, or seek legal advice. This can lead to potential oversights or misunderstandings in the selling process.

4. Potential Scams: Some wholesale buyers may be less reputable or transparent in their dealings. It's important to thoroughly research and vet potential buyers to ensure that you are entering into a legitimate and fair transaction.

5. Lack of Market Exposure: Selling to a wholesale buyer may limit your property's exposure to the market, potentially resulting in a missed opportunity to receive a higher offer from a traditional buyer.

It's essential to carefully weigh the risks and benefits of selling to a wholesale buyer or investor and consider consulting with a real estate agent or attorney to ensure a smooth and fair transaction.

What are the risks with a purchase contract that the buyer intends on reassigning prior to close of escrow?

When a buyer intends to assign a purchase contract to another party prior to the close of escrow, there are certain risks involved for both the seller and the original buyer. Some of the potential risks include:

1. Uncertainty: The seller may face uncertainty regarding the final buyer and their ability to perform according to the terms of the contract. This can create delays, complications, and potential disputes during the transaction.

2. Multiple Parties: The involvement of multiple parties in the transaction can lead to communication challenges, conflicting interests, and issues with coordination and agreement on terms.

3. Financing Issues: The final buyer who takes over the contract may encounter financing difficulties or fail to secure a loan, jeopardizing the sale and causing delays or even cancellation of the deal.

4. Contractual Obligations: If the assignment is not clearly outlined and approved in the original purchase contract, there may be legal implications or challenges related to the assignment process.

5. Renegotiation: The final buyer may seek to renegotiate the terms of the contract, leading to additional negotiations, changes in pricing, or other modifications that may not be in the best interest of the seller or the original buyer.

To mitigate these risks, it is important for all parties involved to clearly communicate, document the assignment agreement, and ensure that all terms and conditions are clearly outlined and agreed upon by all parties. It may be advisable to seek legal advice or consultation from a real estate professional to navigate the complexities of an assigned purchase contract effectively.

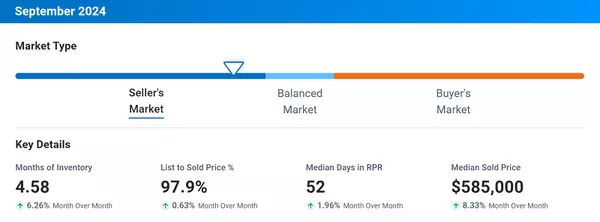

📊 Discover the market value of your home.

☎️ Mobile 602-517-4463

📧 Mail@JasonPetersonRealtor.com

🌐 JasonPetersonRealtor.com

Categories

- All Blogs (871)

- Calculators & Financing (13)

- Certifications & Designations (34)

- Client Reviews & Testimonials (63)

- Do you need a REALTOR®? (59)

- eXp Realty (8)

- FAQs, Tips & Tutorials (234)

- From our Family to Yours (37)

- Home Valuation (42)

- Homebuyer (186)

- Homeowner & Home Seller (124)

- I'm Your ABR (92)

- Jason Howard Peterson (98)

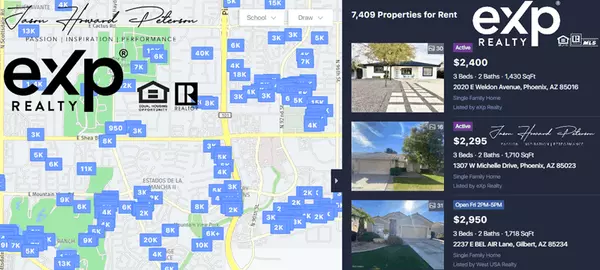

- Landlord & Tenant (68)

- Listed, Leased & Sold (86)

- Market Watch: Reports & Trends (201)

- Meet Your Agent (31)

- NAR Changes/Updates (22)

- Valley of the Sun (55)

Recent Posts

GET MORE INFORMATION